Enough of the accusations and finger pointing, how about taking action to stop the nonsense before the world becomes the victim of the hoarders of black gold. Oil prices continue to set daily records while politicians, industries and economists twiddle their thumbs and speculate on the speculators while accomplishing nothing.

More than anything else the spiraling price of black gold is a reflection of the attitude of the world toward the United States foreign policy and the last few years America has taken a beating in international relations. What we as a nation do in the Middle East, in Asia, in South America and in Eastern Europe has directly impacted on oil prices as many nations that produce the precious oil oppose our foreign policy.

Take the Middle East for example where we have propped up the Saudi Arabia kingdoms for decades, a Muslim nation, while giving a blank check and unlimited arms to Israel to oppose the Muslim nations. Along the way we save Kuwait from an invasion by Saddam Hussein and Iraq and then we obliterate Hussein because of phony “weapons of mass destruction” intelligence. Now we occupy Iraq and after five years nothing is even approaching the life they had under Hussein.

First let us look at oil production in the world. As of February 2008 the following are the top oil producers shown in millions of barrels per day. Russia 12.93, Saudi Arabia 8.81, United States 7.40, Iran 3.93, China 3.82, Canada 3.50, Mexico 3.46, UAB 2.59, Venezuela 2.44, Norway 2.44, Iraq 2.37, Kuwait 2.29 and UK 1.65.

These are the top oil consumers of the world again in millions of barrels per day. United States 20.7, China 6.5, Japan 5.6, Germany 2.6, Russia 2.5, India 2.4, Canada 2.3, Korea 2.1, Brazil 2.1, France 2.0, Mexico 2.0, Italy 1.9, Saudi Arabia 1.9 and UK 1.8.

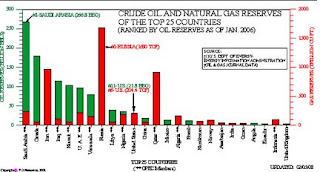

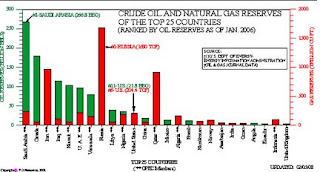

Finally these are countries with the most oil reserves in the world reflected in billions of barrels of oil. Saudi Arabia 266.8, Canada 179.0, Iraq 130.0, Iran 105.0, Kuwait 100.0, United Arab Emirates 100.0, Venezuela 80.0, Russia 60.0, Libya 41.5, Nigeria 36.2, United States 21.0 and Mexico 20.0. Five of the top six are Arab OPEC members and they control 55% of the world oil reserves, while all of OPEC controls 70% of all the world reserves.

Saudi Arabia has the largest oil reserves in the world, while Iraq has the third largest oil reserves in the world. The United States has spent hundreds of billions of dollars defending those countries yet these two countries have made little effort to help us during the recent oil price increases. Iran is yet another oil giant and ever since our ill-fated backing of the Shah of Iran over the people we have struggled to benefit from their oil reserves.

In fact, of all the Arab countries with substantial production and reserves, Saudi Arabia, Iraq, Iran, Kuwait, UAB and Qatar, only Iraq which we occupy has not reduced oil production this year and over the past year. In the case of Iraq they were producing 2.6 million barrels per day under Saddam. Five years after our invasion they are still only producing 2.3 million barrels a day with the third largest reserves in the world. Oil experts have predicted Iraq could produce up to 6 million barrels a day in four years but they didn’t count on the extent of corruption in the Iraq rebuilding budget. All the other Middle East nations have lowered production. Some friends.

Hopefully our leaders understand when people have the reserves and they lower oil production it means they are probably trying to cause economic damage to the USA. Venezuela seems to hate us and they have lowered oil production. On the other hand, we alienated Russia but they still increase oil exports. Our relationship with China is not particularly good but even China has increased production while lowering their projected oil needs. Canada and Mexico, our neighbors, have increased production yet we seem to ignore them or take actions against immigrants for example that contributes to our negative image. In spite of that Canada and Mexico are still trying to help.

So we can count on our friends Canada, Mexico, Russia and China to help with the oil price mess. I doubt many people consider Russia and China friends of the USA but at least they are working to minimize oil prices. In Russia they took care of the speculators and crooked oil companies by nationalizing the companies. It seems to work as they produce nearly 10 million more barrels than they need and refuse to be part of OPEC.

So is there a problem with inventories? Not really. Although U.S. crude oil inventories may be down according to Tim Evans, an energy futures analyst at Citigroup's Futures Perspective, the gasoline inventories are at their highest level since March 1993. In spite of OPEC world oil production was up 2.5% in the first quarter of 2008 over the same period in 2007 while world oil consumption rose just 2%. World production is projected to be 3.3% higher in the second quarter and 4.1% higher in the third quarter than the same periods a year ago while world demand is projected to rise by just 1.6% over the next six months.

The tenuous nature of the economy has caused oil demand to fall in some countries. According to economist John Kemp at the commodities firm Sempra Metals, the U.S. consumed 4% less petroleum in January 2008 than it did the year before. With China reducing the expected increase in oil demand world surplus oil production capacity has gone from a very tight 1.5 million barrels per day a couple of years ago to more than 3 million barrels today, says petroleum economist Michael Lynch.

So supply is up and relative demand is down. Inventories are up and reserves are more than adequate, yet the price of oil continues to rise. Why? Exxon Mobil CEO Rex Tillerson blamed a third of the recent run up in oil prices on the weak dollar, another third on geopolitical uncertainty, and the rest on market speculation.

I have my own reasons and they can’t be any worse than Mr. Tillerson. We can blame a fourth of the rise on the Demon Retribution for Bush foreign policy, a fourth on the Demon Manipulation for oil company tax and refining capacity shenanigans, a fourth on the Demon of Deceit for conflicts of interest in our financial institutions, banks and media where expert oil analysis profits the companies with no disclosure of the analyst ownership conflicts, and a fourth Demon of Greed in market speculators who are probably the same financial institutions, banks and media experts manipulating the price through the futures markets.

Note that I have not mentioned congressional inertia, Administration bungling, the federal agency non-responsiveness nor the media ignorance as major factors in the price run up because I can’t imagine they have any ability to react quickly to anything while the coffers of the national political parties and candidates are so bloated from oil company contributions their reaction would be highly impaired. As for the media, well look where the advertising revenue comes from to pay for the network news team that covers the news.

Is there hope? Sure. The Mayan calendar says the world will end in the last year of the new presidents 1st term, 2012. That would certainly bring an end to foolish politics, haphazard enforcement of corruption laws, rampant greed and spiraling oil prices.