Friday, April 01, 2016

American Elections 4 - Tips for International Followers - Who is the Dreaded Establishment in the American election?

Tuesday, June 09, 2009

Obama's Helter Skelter Agenda - Maybe Harvard Wasn't Ready for the Presidency

Oh yes, the fact checkers may say "wasn't George Bush, Jr. a Harvard Business School grad" and the answer is yes but based on what he did with the economy and what Obama has done since taking over it might be something that Harvard may not want to talk about. Besides, Bush was a Yale undergraduate while Obama was a Columbia undergraduate.

Now Obama seems to be a nice enough kid. Maybe he made a few mistakes because of his lack of experience, mistakes getting to the White House and mistakes now that he is there, but in spite of his claims that being a community organizer qualified him to run the economy, fix Wall Street and give us all health care, we now know that is just plain nonsense.

I don't remember anyone in the campaign telling us the Obama Administration would be an on-the-job training program for future liberal leaders rather than the president of all the people all the time. His gang has ignored Republicans and Independents and tried to use the Democratic majority in Congress to jam legislation down our throat.

The Obama handlers seemed to forget that just 53% of Americans voted for Obama while 47% opposed him. His was not an overwhelming public mandate but a referendum on the Bush Administration which seemed to be drifting aimlessly the last few years in office. Even Adlai E. Stevenson of Illinois, the last famous liberal presidential candidate from Illinois and three time loser could have beat Bush last year.

Unfortunately for the Republicans Bush was soooo unpopular Speaker Nancy Pelosi was able to get a Democratic majority in the House and Majority Leader Harry Reid got one in the Senate thus, in their minds, giving the president an ironclad veto proof majority in Congress.

So after promising us a break from old style politics and transparency and no lobbyists and prosecution of crooks and new ideas, etc., etc., etc. Obama was able to use the Pelosi-Reid majorities and slam a massive amount of legislation down our throats to fix all the things the Republicans screwed up the past 8 years. It was a great opportunity and a historic landslide of laws but they were written by the same old politicians and lobbyists who were already owned by the special interests from Wall Street to Union Leaders and the laws were filled with the same pork barrel projects we always expected before.

As for the Emergency stimulus bill which Obama touted as the savior of America at a cost of $787 billion to fund shovel-ready projects that could be implemented immediately, we are entering the 5th month since passage and so far the accelerated efforts of Obama have managed to get $44 billion spent, just 5% of the money. Most was probably for unemployment benefits which has nothing to do with stimulus.

In spite of the failure of the program, the economy continues to recover meaning why did we need the program in the first place? We didn't. But Obama did to fund all the none stimulus social agenda he wanted to advance the liberal cause in the nation. Our secret march toward socialism will leave an amazing legacy if left unchecked by Congress.

In less than six months since Obama took office the USA has borrowed more money than the entire amount borrowed during the previous 30 years. In terms of foreign countries of course China continues to hold the biggest mortgage on the future of America with $767.9 trillion in US debt and a total of $1.4 trillion in US debt and US currency. Since we forced Chrysler and GM into bankruptcy and Fannie May and Freddie Mack were bailed out with federal ownership I guess that means China and the other foreign debt holders will own America's largest auto and mortgage companies as well.

The top 7 foreign debt holders are China ($767.9 b), Japan (686.7 b), Caribbean Bank Centers ($213.6 b), Oil Exporters ($192.0 b), Russia ($138.4 b), UK $128.2 b), Brazil ($126.6 b), and Luxembourg ($106.1 b) with a total of $3.2 trillion in foreign debt ownership.

Now the Administration takes comfort in knowing the Federal Reserve here in the US owns the greatest amount of US debt, $4.8 trillion, but who owns and controls the Federal Reserve? Not the US government. Not the US president. Not the US Congress. No, the twelve regional Federal Reserve banks are owned by the private banks doing business with the Fed.

The Obama record shattering borrowing has pushed the US into a debt never before seen and he has just begun. Waiting in the wings are more bank and other bailout programs, energy efficient spending, more health care spending, and a crippled Social Security and Medicaid programs all in need of billions and billions of dollars.

The failure of the Obama economists to accurately project unemployment trends led to gross errors in the estimated costs or value of new programs like the stimulus and bank bailout, the bank stress tests, and the US budget revenue and deficit projections. Obama and the Democratic Congress decided the unemployment rate would stop at 8% because of all their spending yet the rate shot to 9.4% in spite of the spending or lack of spending. It will most likely rise throughout 2009 as projected in the Coltons Point Times and peak around 10% before the effects of economic recovery, not stimulus spending, begin bringing it back down.

So far Obama and the Democratic Congress have brought us record unemployment, record debt, record foreign deficits, record foreign ownership of US assets, record bailouts of banks, mortgage companies, insurance, auto and other industries, and record oil prices with no demand to support it.

Even the Obama worshipers like the media, liberals, unions, bureaucrats, teachers, disenfranchised citizens and Democrat puppets are beginning to get nervous about the failures of programs to protect them and their special interests. Wait until they begin to feel the effects of spiraling interest rates and skyrocketing inflation rates to pay for all the liberal agenda which will surely be the result.

Oh yes Obama is a likeable guy. His wife is likeable as well. But being likeable and from Harvard, Columbia and Princeton Ivy League schools as they are does not make one mature, street smart nor able to govern any better than a Ronald Reagan also from Illinois who attended tiny Eureka College with a student body today of just 750 students.

Thursday, May 28, 2009

Deflation - An Economist's Illusion or the Real Deal?

To understand what people are talking about let us take a look at the Ask.com definition of the term "deflation" and what it really means.

Question: What Is Deflation?

Answer: The definition of deflation is when asset and consumer prices continue to fall. This may seem like a great thing to consumers, except that the cause for deflation is a long-term drop in demand.

Unfortunately, a drop in demand means that a recession is already underway, with job losses, declining wages, and an ongoing decline in the value of your home and your stock portfolio. Deflation is a result of businesses dropping prices in a desperate attempt to get people to buy their products.

Officially, deflation is measured by a decrease in the Consumer Price Index. However, the CPI does not measure stock prices, which retirees use to fund purchases, and businesses use to fund growth. It also does not measure housing prices, instead using rental equivalent. This often lags home price declines, and underestimates deflation in the CPI.

To combat deflation, the Federal Reserve executes an expansionary monetary policy. It reduces interest rates, and increases the money supply in an attempt to jump-start economic growth. In addition, the government can offset deflation with expansionary fiscal policy. It can put more money into circulation by lowering taxes, increasing government spending, and incurring a temporary deficit to do so. Of course, if the deficit is already at record levels, that tool may no longer be available.

Like inflation, deflation is very difficult to combat once it is entrenched. As businesses and people feel less wealthy, they spend less, reducing demand further. Prices drop in response, giving businesses less profit.

I don't know about you but it seems to me gas has started rising again. In fact the price per barrel of crude oil, which impacts on many supplemental products from transportation to fertilizer, has increased 90% since the beginning of this year alone and now stands at about $62.00 a barrel. No wonder OPEC did not reduce the amount of oil produced this week when the price now is above the 2007 prices in place before the outrageous price spiral.

Taxes are certainly up, especially state and local taxes, and you can bet the aftermath of the incredible federal spending will be substantial future price increases. Obama has already set a new record for the annual federal deficit and the stimulus and bailout programs are just starting to spend money with multi-billion dollar bailouts waiting in the wings for a bankrupt Chrysler and General Motors and a teetering AIG insurance giant.

A lot of food prices are up or they have cleverly repackaged items so we are paying the same for less goods, thus really increasing the price. Organic foods are not dropping either even though there has been a push to be healthy and sales are up.

Certainly restaurant prices do not seem to be falling. In fact with the addition of designer coffee in McDonald's some prices are actually going up as well. When there are "specials" it usually means you get a silver dollar sized hamburger instead of the meat eaters delight we've grown to love.

Medical and health insurance rates continue to spiral in spite of the Obama efforts to overhaul the health care industry. After a decade of double digit annual price increases this year prices are expected to drop down to just a 7% increase. Only in our nation's capitol could a 7% increase be treated as a drop in prices.

As the definition said, two of the most important cost factors missing from the deflation figure are stock prices and housing prices. No one will question that these two have dropped with stocks, and your retirement funds, still about 40% less in value than a year ago.

Housing prices have also gone down, a lot in some areas. But the national market tends to be local market driven so one area may have no loss in value over the recent years (2006 - 2009) while a neighboring area could have substantial loss of value.

Take, for example, the case of Coltons Point. The Washington, DC metro area including Northern Virginia and Maryland has suffered an overall loss of value of about 24% the past year. However, a Washington Post survey of all home sales in the metro area the past year shows there are a few locations where prices have actually increased. One of these unique areas is the riverside resort of Coltons Point where values have increased by over 3% the past year.

Still nationwide stock and housing prices have dropped but neither is even factored into the deflation model which makes me wonder just what value is the economic news on deflation? It is distorted since it missed two of the biggest cost factors. The Consumer Price Index which is the basis for determining inflation or deflation is often a lagging indicator of economic performance much like unemployment figures. Conversely the stock market is a forward indicator of economic growth having already factored in jobs reports before they are even released.

The Labor Department figures on new unemployment claims this week dropped well below analysts expectations for the 2nd time in three weeks yet the unemployment rate climbed to 8.9% and the lagging figure could reach 10% later this year even if the economy is in a full recovery cycle as the Coltons Point Times and more recently other financial news services are beginning to predict.

In light of all this conflicting information and simultaneous upward and downward economic pressure my advice is for you to ignore deflation and inflation reports and the endless speculation about them as it is something the Federal Reserve must manage and we the people have no role in what the Federal Reserve does with our money anyway.

Thursday, April 09, 2009

Obamamania Thrills Liberals and Socialists Throughout the World

What happened to the new era of ethics in government? What happened to his ban on lobbyists working for him? His appointees quickly violated both of those promises. I don't remember him saying he would generate more national debt in four years or less than Bush did in eight years.

Now we discover he sent the Congressional Black Caucus to negotiate with Fidel Castro to open our borders to Cuba. Okay, if the average Cuban makes $9 a month under the Communist country aren't they going to become illegal aliens trying to get into America as well? And besides, the Black Caucus was never approved by the Senate to negotiate treaties.

He spent trillions more than he promised in just his first year and even spent a trillion on stimulus when less than a third of it can actually stimulate. Big cars are gone. Bank accounts are empty. There will be no drilling for oil though millions of gallons are there to drill.

He doesn't bow to the Queen of England but does bow to the King of Saudi Arabia. Countries at the G 20 and NATO meetings greeted him cordially then refused to do anything he asked. He can't even make up his mind about the dog for his kids.

He promised no pork bills from Congress would be allowed yet thousands of pork projects costing billions of dollars have already been signed in to law by him. What happened to reforming our corrupt campaign laws? Where is the new level of ethics? What has been done to stop special interest groups from buying the influence of Congress?

We know stem cell research has been expanded. The floodgate to more abortions have been raised as if 50 million abortions already performed in America were not enough. We know we won't be in Iraq long even if the country falls apart when we leave. And that bad prison in Cuba will be closed although no one knows where the hundreds of terrorists will be set free.

All in all our new president is off to quite a start. Now he did get something right, he picked North Carolina to win March Madness. Stay tuned.

Tuesday, April 22, 2008

POLITICIANS and the OIL CRISIS – The SILENCE is DEAFENING

The laws of supply and demand have been obliterated by the forces of greed and the price of oil continues to increase every day setting new records driving the price of gas, diesel and aircraft fuel to record highs. Americans drive less, consume less, and spend less and still the price spirals out of control. So why are the people we entrust to lead us silent?

Why are we spending $500 billion to save Iraq in which they were going to repay yet we can’t get the revenue from the oil now being produced by Iraq? Did you know Iraq was producing 2.6 million barrels a day of oil before the American invasion? Just last February production reached 2.4 million barrels a day. In spite of the Bush military surge the oil production can range from 1-2.4 million barrels a day depending on the latest bombing targets by Al Qaeda.

The Bush boys tell us oil was not a factor in the war but did they also mention Iraq has 112 billion barrels of oil reserves, second in the world to Saudi Arabia? They also have 112 trillion cubic feet of natural gas reserves. Economists expect Iraq to reach 6 million barrels a day in production in four years yet none of it seems reserved to repay the USA the $500 billion plus or supply some of the USA needs. In fact, if Clinton or Obama get their way and we pull out of Iraq China or Russia will step in and take control of the 2nd largest reserve of oil in the world.

If refining capacity is a problem, which it is, why aren’t we fast tracking new refineries? No new refineries have been built in America since 1976 when crude oil sold for $12.37 per barrel compared to $112 per barrel today. Based on our military and aircraft needs alone increased refinery capacity should be a matter of national security. Perhaps American oil companies should build refineries in secure friendly countries as well?

Reduce our plastic use in fast food containers, bags and the many other uses, all which are very detrimental to the environment, and oil use goes down. A dual benefit and no one seems to be calling for the change. Paper bags always worked well and hemp stands ready to fill many of our needs if the federal government ever realizes you can’t smoke the stuff.

Any oil producing country dependent on our food should be selling us oil at a discount and most countries of the world are dependent to a large degree on our food. Fact is food is the one commodity more important to world stability than oil as you can see from the current food riots around the globe.

Require one third of all cars sold in America achieve 50 miles per gallon in 3 years and a substantial drop in demand will be achieved. Current regulations concerning the average mileage for an auto manufacturer’s fleet are ludicrous with the truck and SUV exemptions. Forget the fleet averages, the economy and cost of fuel will dictate buying patterns.

Besides, let American consumers decide if they want to pay extra for gas, it is supposed to be a free society. If a high mileage car is available consumers will buy it. We know it can be done because I have a 1946 Austin (UK made) that got 50 miles per gallon. If we could make them 62 years ago we can make them today.

Encourage Americans to stay home and take local trips rather than long vacations, subsidize mass transit to reduce autos on the road, and increase train use for up to 500-mile trips. When it comes to intercity travel trains come out on top of all other transit modes other than walking or bicycles.

Extensive data and statistics are available which show that passenger trains consume just one-quarter to one-third of the energy which automobiles and airliners consume, a fact the DOE refuses to acknowledge. Buy more trains and subways, we already own the facilities and right-of-way, and save on energy use, emissions and road maintenance.

Oh yes, what about the tax on gasoline and diesel fuel? State taxes can range from 14 to 45 cents per gallon and combined with federal taxes that are 18 cents a gallon the government gets an average of 45.9 cents per gallon, with states typically ranging from 32.5 to 63.5 cents in taxes per gallon. How about suspending taxes and not just the federal like McCain said? Perhaps a tax credit or full deduction for gas taxes paid might help.

Now these are just a few of the things politicians could be saying to help our short and long-term energy needs. Why are they silent? They are the office holders or want to be our elected representatives. I guess even experience doesn’t help politicians solve problems.

Wednesday, April 02, 2008

PIGS, PORK, PROMISES AND POLITICIANS – ELECTION 2008

Was it just 16 months ago that Nancy Pelosi, newly elected Speaker of the House and leader of the Democratic majority that took over the House and Senate declared that: "The election of 2006 was a call to change — not merely to change the control of Congress, but for a new direction for our country. Nowhere were the American people more clear about the need for a new direction than in Iraq. The American people rejected an open-ended obligation to a war without end.”

Pelosi, third in line to be president, the first woman to ever get that close, promised to spend the first 100 hours in control of Congress to begin to "drain the swamp" after more than a decade of Republican rule. A legislative package was included in the 100-hour promise along with the Iraq war promise and even a major cutback in pork barrel spending by congress.

As the deadlines came and went and congress still sputtered under new management about the only thing that changed was the approval rating for congress as it went into a freefall and plunged to the lowest levels in polling history, reaching around 13%, compared to the highly unfavorable president they were after whose rating also plunged to around 30%, still almost triple that of congress.

Her agenda for change was swept under the carpet along with all the campaign promises and the longer the Democratic contenders for president battle it out no one will notice how the new Democratic leadership failed to deliver on all their promises. And now Pelosi wants Bush to boycott the Olympic Opening ceremonies in China, yet another misguided effort that will only snub the USA Olympic team whose entire lives have been dedicated to representing us in China.

Concerning pork barrel spending, Nancy promised to reduce the spending by 50%. Every year since he became president Bush tried to eliminate the spending altogether but to no avail. So with a new House Speaker and a promise for reform things looked up and the first year the pork barrel did drop from $29 billion in 2006 to $13.2 billion in 2007 for 2,668 projects although the Bush vetoes had a lot to do with it.

Now we are in the second year of Pelosi rule and lo and behold, the pork barrel spigot seems to have been turned back on with expenditures rising to $18.3 billion for 12,881 pet projects. In just one year we went from a 60% reduction in spending to a 40% increase in spending, what a stunning turnaround. I guess Nancy forgot to mention she was only going to stop pork barrel for one year. And who is the national leader in pork barrel projects, why Hillary Clinton of course. Now just how are things changing for the better?

Wednesday, March 19, 2008

J.P. Morgan Chase buyout of Bear Stearns – A Trillionaires Delight

Somewhere in the trillionaires room of Heaven three old codgers are sitting around a table smoking cigars and chuckling over the J. P Morgan Chase & Company buyout of Bear Stearns for a paltry $2.00 a share. Not so much because the price had been over $130 a share a few weeks earlier but because the Federal Reserve Board put up $30 billion of the government’s money to guarantee the sale.

Yes, Mayer Amschel Rothschild, J. P. Morgan and John D. Rockefeller, patriarchs of three of the most powerful family fortunes in history have waited nearly two centuries to see their dreams fulfilled. Perhaps such patience is why their families have remained successful by steadfastly maintaining the rules of the game as set down by their founders.

It was 248 years ago, in 1760 that Mayer Amschel Rothschild created the House of Rothschild that was to pave the way for international banking and control of the world’s resources on a scale unparalleled and somewhat mysterious to this date. He disbursed his five sons to set up banking operations throughout Europe and the various European empires.

"Give me control of a nation's money and I care not who makes the laws."

Mayer Amschel Rothschild

In time the House of Rothschild was able to take control of the Bank of France and Bank of England and relentlessly pursued an effort over two centuries to control a national bank in the USA. By 1850 it was said the Rothschild family was worth over $6 billion and owned one half of the world’s wealth.

From oil (Shell) to diamonds (DeBeers) to gold (from 1919 until 2004 a Rothschild was permanent Chairman of the London Gold Fixing committee which met twice a day in the Rothschild offices in London) the Rothschild’s quietly accumulated a foothold in critical industries and commodities throughout the world.

A master at building impenetrable walls around his family assets the current value of the Rothschild holdings are estimated to be between $100 and $300 trillion, yes that is trillion dollars! Now for a point of reference the current United States National Debt is $9.4 trillion.

J. P. Morgan began as the New York agent for his father’s business in London in 1860 and by 1877 was floating $260 million in US Bonds to save the government from an economic collapse. In 1890 he inherited the business and in 1895 bought $200 million in US Bonds with gold to again save the US economy.

“If you have to ask how much it costs, you can't afford it.”

J. P. Morgan

By 1912 he controlled $22 billion and had started companies such as US Steel and General Electric while he owned several railroads. Morgan was also an American agent for the House of Rothschild in London and used the Rothschild resources to help people like John D. Rockefeller.

Rockefeller, who started Standard Oil in 1863 with the help of Morgan, grew his company into the largest oil company in the world and by 1916 Rockefeller was the first billionaire in American history. In 1909 he had set up the Rockefeller Foundation with $225 million and donated nearly a billion more dollars to various causes. The Rockefeller family fortune is estimated to be around $11 trillion today.

“The way to make money is to buy when blood is running in the streets.”

John D. Rockefeller

So what did they have in common these extraordinary capitalists? They all were dedicated to owning a national bank in America so they could determine the fiscal policies of the nation and earn interest on the debt of the nation.

Rothschild agents in 1791 formed the First Bank of the United States but intense opposition to foreign ownership by President Jefferson and others helped kill it by 1811. A Second Bank of the United States was formed in 1816 once again by Rothschild agents and this time they secured a 20-year charter. However, President Andrew Jackson was also opposed to foreign ownership and withdrew the federal deposits in 1832 as part of his plan to kill the bank charter in 1836.

An attempt to assassinate Jackson in 1834 left him wounded but more determined than ever to stop the central bank. Thirty years later President Lincoln refused to pay international bankers extremely high interest rates during the Civil War and ordered the printing of government bonds. With the help of Russian Czar Alexander II who also blocked a similar national bank from being set up in Russia by the international bankers they were able to survive the economic squeeze.

Lincoln said, "The money powers prey upon the nation in times of peace and conspire against it in times of adversity. The banking powers are more despotic than a monarchy, more insolent than autocracy, more selfish than bureaucracy. They denounce as public enemies all who question their methods or throw light upon their crimes. I have two great enemies, the Southern Army in front of me and the bankers in the rear. Of the two, the one at my rear is my greatest foe. Corporations have been enthroned, and an era of corruption in high places will follow. The money power of the country will endeavor to prolong its reign by working upon the prejudices of the people until the wealth is aggregated in the hands of a few, and the Republic is destroyed."

Both Lincoln and Alexander II were assassinated. In 1881 James Garfield became president and he was dedicated to restoring the right of the federal government to issue money like Lincoln did in the Civil War and he was also assassinated.

Finally along came 1913 and the US was again suffering from a weak economy and there was a threat of another costly war, a world war this time, and business tycoons J.P. Morgan, John D. Rockefeller and E.H. Harriman were part of a group that got Woodrow Wilson to sign into law the Federal Reserve Act creating a network of 12 privately owned banks as part of a new Federal Reserve network.

One of the largest stockholders in the new Federal Reserve was the House of Rothschild through their direct and indirect holdings. A few years later it was disclosed that the Rothschilds also owned about 20% of J. P. Morgan. In time Morgan would merge with the Chase Manhattan Bank of the Rockefellers.

Years later John F. Kennedy opposed a private national bank and was assassinated in 1963 and Ronald Reagan opposed a private national bank and in 1981 an attempt was made to assassinate him. Coincidence or not the opposition to a privately owned national bank was a common characteristic to all these successful assassinations and assassination attempts.

Which brings us full circle to the present bailout of Bear Stearns by J.P. Morgan Chase & Company and we find the Rothschild, Morgan and Rockefeller families are all conveniently part of the same group benefiting from the bailout and the $30 billion guarantee by the Federal Reserve. This is the third time the J. P. Morgan Company has come to the rescue of the American banking system and economy.

Tuesday, March 11, 2008

IS OIL BAILING OUT THE SUB-PRIME MORTGAGE MESS?

We all know how the investment banks, financial institutions and brokers tried to manipulate the American mortgage market and in their greed lost site of good business practices and created a stock scam called sub-prime mortgages which were then packaged and sold by Wall Street. With the feeding frenzy created by this illusion of housing prices raising ad infinitum the greed moguls and the greed mongers accepted millions of mortgages from people with no ability to pay them.

Stock was sold over and over again until the very citadels of our financial sector, the very banks and investment houses we rely on to protect our savings, protect our retirement and manage our economy were inundated with high risk holdings. Then a very unusual thing happened, truth prevailed. Housing prices stopped increasing because they were already way beyond the real value of the property.

Suddenly our trusted money managers were left holding billions and billions of dollars in inflated adjustable rate mortgages, and the home purchasers had no chance to make the escalating monthly payments. Mortgage defaults by the millions were set in motion and the money managers, also entrusted with our hard earned savings, retirement funds and stock holdings, lost billions and billions of real dollars, a total estimated at over $215 billion on mortgages alone.

Then the stock market prices collapsed as the backbone of our financial sector was swamped in losses and unable to explain how greed overshadowed laws and how they were willing to sacrifice the financial well-being of their clients to protect their own jobs, bonuses and buys out to the tune of hundreds of millions of dollars. So where do the pillars of finance stand today?

To avoid bankruptcy and avoid sending the world into economic crises they secured massive amounts of money from China, other Asian countries and the oil rich Arab world. So what is the price they paid to be bailed out by foreign money? Better still, what is the price we paid for our financial citadels to be bailed out by foreign money?

Today we see the same laundry list of financial powerhouses trying to regain their strength and stability in the market and lo and behold what happens to the market? First the oil prices defy every law and principle of accounting and keep skyrocketing at a pace never seen before. Second, virtually all other sectors of the market with the exception of gold collapse, almost as if being forced down so SOMEONE can step in and buy stock at depressed prices to salvage their balance sheets.

If this were a thoroughbred race, yet another industry being taken over by the Arab oil money, one would say the big fix is on. Something very crooked is being done to make someone an awful lot of money and they are playing with grey areas of the law to make it happen.

Well Congress and the presidential candidates should ask who is benefiting from the spiraling oil and gold prices and the collapse of the stock market. Then Congress and the candidates should do something we haven’t seen in many years. Do something about it! If the financial institutions that lost $200 billion of our dollars, not theirs, have decided to artificially maintain high oil and gold prices and low stock prices so they can regain their credibility and stave off any investigations by a gutless congress and the more gutless international group called the World Bank then maybe it is time to repopulate the jails with people who deserve to be there.

Every financial institution in the world should be investigated to determine if they are profiting from the rigged oil prices of today. Expose their layers of hidden equity to see if they are owners of oil related companies or markets responsible for setting the oil and gold prices. See if they invested in such companies for themselves or if they allowed their little investors to benefit by including them in the holdings.

See if there is collusion between the oil producers, futures markets and banks and investment houses to prop up the oil price in order to offset the billions in sub-prime mortgage losses. And when you find the evidence, then do something about it. Oh yes, and while you are at it you better stop taking the millions of dollars in campaign contributions being thrown at you by these blood-sucking profit rich companies or you are also part of the corruption that has cast a dark shadow over the lands.

Public enemy number one in the oil crisis are the energy analysts and while there used to be just a conflict of interest involved because some analysts work for companies with major oil holdings, recently the government analysts like the U.S. Department of Energy have further fueled the oil price spiral with dismal forecasts for summer prices.

These analysts cannot explain what is happening in economic terms, as there is no justification for the profit gouging. So why are they not probing into the financial collusion that may exist and may be driving the prices up? If an analyst cannot tell us what is going on in the market then they have no business speculating on the future prices.

If there is market manipulation to virtually guarantee excessive profits then why is the U.S. Justice Department silent? What about the Federal Trade Commission or the Securities and Exchange Commission or the Interstate Commerce Commission or all the committees in the House and Senate looking out for our interests? Don’t any of them see that their continued silence is allowing the worst-case scenario to happen?

In the end, no matter what government action does or does not take place, every member of the House and Senate that ignored the public during this time of crisis should be thrown out of office for benign neglect of the public interest and if they accepted campaign contributions from these industries and they are proven guilty of price manipulations then the members of Congress should be impeached.

Tuesday, February 26, 2008

CPT SPECIAL - WHO CAN YOU TRUST???

We are introducing a new feature of the CPT identifying for you the handful of prominent people in the world we believe you can actually trust. When these people happen to come from the finance sector it is even rarer that they can be trusted. So our first entry into the CPT Trusted Hall of Fame is Mellody Hobson.

Mellody (born April 3, 1969) is the president of Ariel Capital Management, LLC, a Chicago investment firm managing over $14 billion in assets. She is a regular contributor on financial issues to ABC’s Good Morning America. Hobson was born in Chicago, Illinois and graduated from Princeton University in 1991 with a degree in South African Studies. She joined Ariel soon afterward as the firm's senior vice president and director of marketing until ascending to president in 2000.

Hobson serves on the board of many organizations, including the Chicago Public Library, the Field Museum, the Chicago Public Education Fund, and the Sundance Institute. She is also a director of the Starbucks Corporation, The Estee Lauder Companies, Inc. and Dreamworks Animation SKG, Inc.

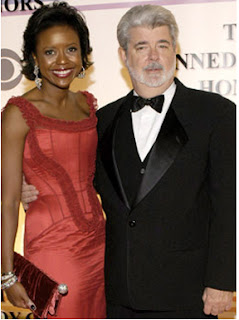

One of the world's most eligible bachelorettes, Mellody is dating George Lucas of Star Wars fame who also happens to be one of the few nice guys in Hollywood not caught up in the movie industry hysteria. Mellody, way to go girl!