Since Obama just came to the realization that while he pursues the agenda of Wall Street payoffs, of international adulation, and of institutional socialism, the people of America now know he is totally out of touch with Main Street. A year after being elected he finally realized that jobs, the economy and the deficit are the people's priorities if not his.

This week he made a feeble effort to show his concern for the economy but before the week had ended he showed his true colors when was off to Oslo to pick up the Nobel Peace Prize then off to Copenhagen to commit America to global warming initiatives designed more to pad liberal pockets than benefit the people.

Obama is the first person in history to win the Peace Prize the same time he was ordering a massive expansion in the War in Afghanistan. This is the same president who consistently blasted former President Bush for the war in Iraq, then Obama declared Iraq stabilized and withdrew American troops from the front lines. This week over 131 people were killed in five bombings within the supposedly secure Bagdad capitol.

Since the Obama troop withdraw from populated areas ordered by Obama on June 30 the Iraqi people have been faced with a bloodbath. In the entire war 94,500 Iraqi citizens have been killed, over 1243 in Bagdad alone this year. The US military has suffered about 4,367 total deaths in Iraq. As of this writing there are still about 124,000 troops in Iraq.

That it a precursor of the illusion being proffered by the Obama gang to bury the truth in a fog making it impossible to know what is really being done. When it comes to the economy and jobs, the truth is far more limited and self-serving than one might expect of the president of all the people.

Several types of people seem to dominate the Obama White House and work for the Chicago gang. There are the academic intellectuals, the social activists, the special interests and the Wall Street protectors. In terms of experience and understanding of the economy, those that do understand it have an agenda far removed from the public interest. The activists and special interests, on the other hand, seem only concerned with expanding their base, power and control of resources at the expense of everyone else.

Take for example his team of economic advisors. They have several decades of experience manipulating the American economy and regulation of the economy to benefit the banks and bank executives, using the environmental "green" advocates not because of the benefits to humanity but because they represent the most lucrative market for return on investment, the labor unions who have already benefitted from multiple Obama executive orders to force labor wages on all government work at the federal and state levels, and the socialists who often hate the very institution (US government) paying their inflated salaries.

No small businessmen, people with experience creating jobs in the public and private sector, nor people who believe we are spending ourselves into a cycle of self-destruction are part of the Obama team. They would be a roadblock to the socialist agenda of the Obama gang.

Yesterday Obama said he would take a couple of hundred billion dollars not being used in the TARP program and spend it on his new jobs initiatives. At the same time he pledged to attack the problem of reducing the spiraling deficit.

Okay, the TARP money is all deficit financed. If he takes the money paid back by the banks and applies it to the deficit that is nice. If he takes the money not spent yet and uses it to finance the feeble jobs program that is not saving money, it is still adding to the deficit.

The economic logic of the White House seems very similar to the logic of the Nobel Peace Prize committee in awarding Obama's huge troop build up in Afghanistan with the Peace prize. It is the Wizard at work with his illusionist routine but it might as well be Alice in Wonderland where nothing is as it seems.

Here is some basic logic that does work. First, infrastructure projects can only create temporary jobs and even then the labor cost of infrastructure projects is generally a very small percent of the total cost. Since Obama already signed executive orders that will increase the labor costs significantly to union wage levels when many projects were going to be non-union, even fewer jobs can be created. These projects never meet timetables because of the permit process, the public bidding process, extensive environmental regulations and other requirements.

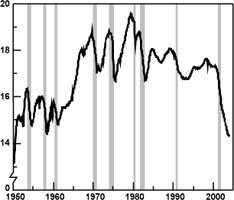

Green jobs are also nonsense as there is not yet a market for the often over-priced green products and services. Obama must be too young to remember the oil crises in the 1970's and 1980's, back when he was a community organizer, self-avowed pot smoker and before he graduated from Harvard in 1991. If he was paying attention he would know oil prices spiraled, gas shortages were prevalent, and "green" technology was supposed to lead us out of the dark.

Alternative fuel, solar heating and cooling and energy conservation were all seen as saviors from the global crisis. We are now 20-30 years later and they still have not saved us from anything. The only element of a rapidly expanding green industry at this time that would be a direct benefit to people would be energy conservation, which was the most successful initiative back in the oil crisis days. However, it was paid for by the utilities, not the federal government.

Also back in the Reagan days there were excess profit taxes, price controls and other legislative actions that saved billions of dollars in consumer costs. The money recovered from oil company overcharges went directly to the states who faced the same budget deficits then they face today. Again, the federal government was not the source of the money but the source of the action that generated the money.

Why doesn't Obama suggest excess profit taxes on Wall Street? How about oil price controls? How about prosecuting some corporate offenders for misuse of our financial system? Billions of dollars in fines should be paid by the white collar crooks for the economic catastrophe they caused.

When evaluating jobs program options one must decide if they are to be temporary or permanent. So far the Obama stimulus program jobs being created are costing over $500,000 each. We would be better off paying the entire cost of a college education for anyone in their last two years of undergraduate and graduate programs in fields leading to professional employment.

I say wait until the last two years so they have demonstrated a commitment to getting the education. Besides, we would be keeping college age people, 20-26, out of the labor force freeing up jobs to reduce the unemployment rolls while lowering the cost of unemployment benefits. At the same time we would be helping the cash strapped colleges and universities while upgrading the quality of the future labor pool in America so we can compete with the Chinese and Indians of the world.

Fields of math, engineering and medical would all be preparing our future labor pool for competition or meeting top priorities such as the need for health industry professionals. If health care were expanded to all Americans tomorrow there are not enough health care people to meet the huge increase in demand. We would be well advised to help train doctors, nurses and specialists for the upcoming surge in health care enrollment.

As for the "green" jobs, I already mentioned the energy conservation (weatherization) was already a huge success through the utility companies. Let the existing utilities generate the jobs where possible and finance the program from utility companies. That way the people benefiting from the program pay for it. Until alternative energy options are viable and thoroughly tested, we need a combination program of conventional and alternative energy.

Natural gas is cleaner than coal and oil heating systems. Oil and coal plants can be much more efficient with reduced carbon emissions so we should adopt the energy independence initiative and drill for domestic, Canadian and Mexican (the North American Independence Initiative) oil and gas reserves that will significantly reduce our foreign oil dependence. I believe a production tax on new oil and gas reserves should be used to finance the completion of alternative energy technologies and the testing and production engineering necessary to make them a viable long term source of energy.

Likewise, a couple of cents per gallon tax on gasoline could be used to finance fleets of electric cars for the government which would help with development of new battery technologies, help auto companies to offset the development costs of these vehicles, and hopefully help reduce the cost of true alternative energy cars to affordable prices which they are not achieving now.

So far none of my proposals costs the federal government anything. However, there are some costs that must be incurred. Infrastructure projects, which Congress and the President like, probably because they reward the labor unions more than anyone, need to have some parameters.

For example, projects that are labor intensive (where more than 50% of the cost is labor) would be given first funding priority. Second priority would be given to projects with 25-50% labor costs. Major infrastructure projects should be funded through a multi-billion dollar government bond program thus avoiding adding to the deficit. Right now the banks are not loaning money nor helping the consumer. Require the banks receiving money from the Federal Reserve or other sources to contribute a significant part of their money to the bond program since they will not loan to small business or people.

As for the private sector, a multi-tiered program should be launched. Small businesses prepared to add to their employment base (perhaps businesses up to 2500 employees) would be given a substantial tax credit for three years for every new employee hired as long as the position is retained during the three years.

Anyone wanting to establish or expand manufacturing capacity in America would be given free use of surplus government facilities, i.e. military bases, airports, warehouses, etc. for as long as they remain in business and retain the jobs. A loan fund at minimum interest would be made available to them to make improvements to the facilities with the facility serving as the collateral for the loans. In addition they would be eligible for tax credits for new positions created for the facility.

A substantial effort will be made to find private companies to produce government developed materials for commercial use. This public-private partnership has been attempted in the past but was dominated by the engineering and research fields when marketing and production engineering resources were needed to make it successful. There are hundreds if not thousands of products developed by the military, NASA, the intelligence agencies and other government bodies that are no longer classified but would be of great value in the marketplace. Companies offering the full range of resource staff would be given preferred treatment.

America once dominated the world in terms of manufacturing and product innovation and there is no reason it cannot do this again. Two things are necessary to move us in the right direction. Innovative companies are hampered by the lack of capital but small business loans should alleviate that problem. The tremendous increase in the cost of testing and patent work has become a barrier to innovation for small businesses.

The Small Business Administration should develop the necessary resources to offer free product testing and patent work to anyone attempting to develop and market innovative ideas in America. This will offset two of the greatest barriers to innovation by small business and individuals and SBA will be in a position to finance the product implementation once the testing and patent work is complete.

These are just the ideas of one person on how to address the jobs needs of America without bankrupting the nation in the process. Ideas such as these also protect us from committing billions of dollars that will not generate meaningful numbers of jobs and will not contribute significantly to the deficit. Okay President Obama, you said you would listen to ideas from anyone on how to create more jobs. Are you really listening?