Once upon a time there was a new nation formed from a repressive past and a fierce desire to achieve individual freedom. A gathering of Americans convened in Philadelphia that summer of 1787 to draft a new constitution for the new nation resulting from the stunning defeat of Great Britain in the American Revolution. Some say it was the greatest gathering of minds in the history of the world.

What emerged was a Constitution and Bill of Rights unlike anything before or since and to this day it has reigned as the predominant constitution in the world. But it was not without pain and debate, much of which centered around the distribution of powers between a strong federal government and state's rights.

By June of 1788 the required nine states had approved the constitution and in January 1789 the new Congress met for the first time. George Washington was elected President of the United States and John Adams Vice President and America was a viable entity.

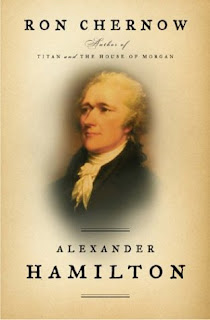

The battle between advocates of a strong national government (federal) and state's rights would continue until this day but major changes took place under the George Washington administration through the efforts of Alexander Hamilton, Washington confidant and first Secretary of the Treasury. This was a time when the Rothschild's international banking family made it's first inroads into the fledgling and lucrative America money machine.

Now most people who slept through American history and economics classes in high school and college think capitalism was a creation of the Revolution along with the American style of Democracy. Wrong. In fact it is one of four major wrongs attributed to our revolution and founding fathers by modern day politicians and a liberal media overwhelmed by Alzheimer's forgetfulness.

Wrong number one, we did not invent democracy, we approved a Republic. Number two wrong, capitalism is not an American creation but European strategy to control countries. Wrong number three, slavery was not an American original but again European strategy to exploit America. Wrong number four, in America the separation of church and state did not separate God from America but the godless from America.

As for our favorite trillionaire family, the Rothschilds, they were there way back then as much as today. Mayer Amschel Rothschild, the patriarch of the House of Rothschild, was from Frankfurt, Germany where his grandfather and father had built a business. In 1755 and 1756 when he was 12 years old his parents died and he was sent to complete an apprenticeship in Hanover working for Wolf Jakob Oppenheimer whose family first exposed him to the benefits of working with royalty.

The Oppenheimer's were court agent to the Austrian Emperor and agent to the Bishop of Cologne. Upon completion of his apprenticeship in 1764 Mayer Amschel returned to his family in Frankfurt and established the House of Rothschild. It was the beginning of the most powerful banking family in history.

The French Revolution and English Industrial Revolution in the late 18th century gave Rothschild the chance to expand his enterprise from Germany to France and England and the House of Rothschild became the first international banking network managing the finances of nations. Of course the golden goose for international bankers was America just emerging from the Revolution and trying to become a nation.

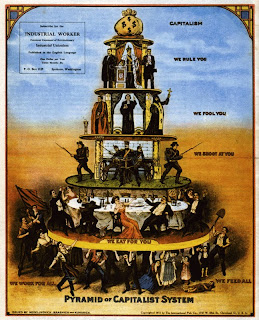

Capitalism, as we know it today, dates back to the middle ages but most historians consider the Netherlands the world's first capitalist nation with the wealthiest trading city, Amsterdam, and the first full time stock exchange which led to insurance and retirement funds, asset and inflation cycles and manipulation of commodity markets in the early 1600's.

The British East India Company and the Dutch East India Company launched a new expansion of capitalism in the early 1600's as state chartered trading companies. Chartered as joint-stock companies they were monopolies with powers ranging from lawmaking to military and treaty-making privileges. This was the first attempt by nations to compete with individual business to acquire and control resources from agriculture to gold, oil to clothing. Individual investors bought into these creations to reduce debt exposure and greatly enhance profit potential.

Money to support the multiple wars and trading companies along with the industrial development and geographic expansion came from the network of international banks led by the Rothschild banks throughout Europe.

In 1791 Alexander Hamilton, one of the leading patriots of the American Revolution and aide-de-camp to General George Washington was serving the first president as Secretary of the Treasury when he got the first Congress to approve a 20 year charter for the First National Bank of America to be run by agents of the House of Rothschild. Considerable suspicion of the dependence on private banks to finance the government surfaced on the part of George Washington, James Madison and Thomas Jefferson and the role of the international bankers made it a highly controversial action.

When opposition to renewing the charter in 1811 peaked the banking family threatened the nation with a crippling war if the charter was not renewed. The charter was not renewed and in 1812 England, the base for the Rothschild banking empire, declared war against America. By 1816 a financially devastated USA chartered the Second National Bank of America to the Rothschild agents.

When Andrew Jackson was president from 1829 to 1837 he was opposed to the National Bank and removed federal money from it. There was an assassination attempt on him in 1835 which the assailant claimed was financed by European bankers. From 1836 until 1913 there was no National Bank but the government was dependent on the New York banks, many of which were controlled by the Rothschild network.

During the Civil War Lincoln went to the New York banks for money for the war effort and was offered funds with interest up to 36%. Furious he refused and began the first printing of money by the federal government issuing $450 million in bonds. Both the United States and Russia under the Czars resisted efforts to establish national banks to finance governments. Ironically both Lincoln and Czar Alexander II were assassinated.

From the founding of our nation our leaders were deeply suspicious of the international bankers and their motives for establishing national banks. The lack of loyalty to the nations, unrestricted usury (interest) fees and lack of assets to back the paper bonds were among the many issues raised against the banks.

"If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash."

George Washington

"I sincerely believe ... that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale."

"The Central Bank is an institution of the most deadly hostility existing against the principles and form of our Constitution."

Thomas Jefferson

"I have two great enemies: the Southern Army in front of me, and the financial institutions to my rear. Of the two, the one in my rear is my greatest foe."

Abraham Lincoln

"No State shall enter into any treaty, alliance, or confederation; grant letters of marquee and reprisal; coin money; emit letters of credit; make any thing but gold and silver coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts, or grant any title of nobility." (Article I, Section 10)

The Constitution of The United States of America

A definition of capitalism might read an economic system characterized by private property ownership; where individuals and companies are allowed to compete for their own economic gain; and free market forces determine the prices of goods and services. Some claim that the protection of individual and property rights is an essential element of capitalism since individuals must be able to keep what they earn through a capitalistic system.

However, since capitalism has been the breeding ground for slavery, excessive usury, manipulation of prices and many other anti-individual matters it seems rather hypocritical to define it with such a noble purpose as individual rights.

In truth capitalism has no moral or ethical requirements, is more comfortable with atheism than Christianity, and has minimal loyalty to nations. First and foremost capitalism is expected to produce maximum profit for the private stockholders and bond holders.

The most recent performance of Wall Street in the sub-prime mortgage market, the oil price speculation, the unwillingness of banks to provide loans, the excessive charges and fees by our banking community and the bonuses, bailouts, stimulus spending and many other economic tricks exercised in Washington would suggest morality is the farthest thing from the minds of the money manipulators.

Our democracy requires a degree of morality and ethics not found in the capitalist system of the House of Rothschild or any other capitalist advocates. Yet our democracy, which is founded on individual rights, freedom and the grace of God requires a degree of morality and ethics not found in the socialist system either which is the opposite of capitalism and has bred the fascist and communist movements of the past century.

The Obama administration seems to think it can combine two wrongs to make a right by giving us extreme doses of both capitalism and socialism at their worst. Bank bailouts, bonuses and market manipulation seem okay to Obama along with a socialized work force, a public medical system and a redistribution of wealth. How silly.

What is needed is a new Constitutional Convention devoted to developing a new system of economics that will support the principles of our American Constitution without abusing the rights of man and woman and our relationship to God.

We have demonstrated greed in government cannot be regulated by those with greed and that Wall Street cannot be regulated by those with profit and the pursuit of materialism as a primary objective. Our Christian foundation may not be present in our religions but it is present in our relationship to God. The only way we can protect and defend the spiritual laws of God, the natural laws of nature and our inalienable rights as man is to eliminate the opportunity for greed from our system.

Do we have the strength to again defend our nation from the clutches of greed, the motives of capitalism and the exploitation of socialism? We shall see. Do we have the will to demand our principles of morality, our exercise of ethics and our relationship to God be protected first and foremost above materialism and greed? We shall see.

Do we have the fortitude to declare our Christian values of charity, compassion and empathy more important than the accumulation of wealth and property? Do we have faith in God and our ability as God's creations to protect individual rights and freedoms for all people from the forces of evil? Do we really believe in anything anymore?

We shall see...

-