.

As we close in on the last days of mankind according to the gaggle of channels and their party line IPhones with the Gods, I thought I might suggest some things to do in preparation.

1. Do not take your money out of the bank as the interstellar chatter might be wrong. Besides, what would you do with it anyway.

2. You might want to go visit someone you actually like just in case you are stuck with the same person in your next life you were with when it ended.

3. If you have a bucket list you only have two weeks to complete it. Consider revising the list.

4. Should you have sensitive documents, like love letters to someone other than your wife or husband, you might want to burn them in case you get zapped out of here and your spouse is left behind and might find them. You never know, he or she might hire a shaman to curse you in your next lifetime.

5. In the unlikely event you have the opportunity to recreate yourself in your next lifetime you best decide who you want to be and secure a picture to take with you to give to the angel in charge of your new you.

6. Figure out a way to practice being weightless since they claim you will have a light body, as in enlightened I presume rather than simply skinny. You might try driving over hills fast to get that weightless feeling.

.

Showing posts with label money. Show all posts

Showing posts with label money. Show all posts

Tuesday, September 29, 2015

Wednesday, July 15, 2015

China and the World Financial Manipulators - It takes a Communist Country to stop the Financial Corruption

.

TheToronto

Star

Government takes desperate measures to shore up market,

while feared internal security police announce they have begun investigating

investors accused of ‘maliciously’ shorting blue-chip shares, as bubble bursts.

--------------------------------------------------

BEIJING —China

Shanghai

Just a week ago, here is what world financial analysts said

about the economic collapse in China .

-------------------------------------------------------------------------

Daily Mail, London

China's tumbling stock markets plunged even further today, intensifying

fears the country was tail-spinning towards the biggest financial disaster

since the 1929 Wall Street

Almost $3trillion (£2trn) – more than the entire economic output of Brazil

China's government, regulators and financial institutions are now waging a

concerted campaign to prop up the nation's stock markets – a move that

failed spectacularly in the 1929 crash that triggered the Great Depression.

--------------------------------------------------------------------------

Here is what the

experts said just three days later.

--------------------------------------------------------------------------

The

China

Government takes desperate measures to shore up market,

while feared internal security police announce they have begun investigating

investors accused of ‘maliciously’ shorting blue-chip shares, as bubble bursts.

--------------------------------------------------

The Washington

In the

latest in a series of desperate measures to shore up the market, regulators

banned major shareholders, corporate executives and directors from selling

stakes in listed companies for the next six months.

Officials

also announced that banks could roll over loans backed by shares.

But, for

some investors, it was the entry of the feared Public Security Bureau (PSB)

that really changed sentiment.

The

powerful internal security police announced they had begun an investigation

into a dozen individuals and institutions accused of “maliciously” shorting blue-chip

shares.

The state news agency

Xinhua said the move showed regulators would “punch” anyone who violates

regulations and the law “with a strong fist.”

But if

those moves calmed some of the panic in the markets, it was far too early to

declare victory, analysts said.

In the course of a couple of days the stock market

experts had declared the worst financial depression since the Great depression

of 1929 would befall China

The instantaneous action by the Chinese stock regulators

and Chinese government left financial experts bewildered, prognosticators

stunned, and crooked financial manipulators running for the border. It seems odd that none of these tactics were

employed by our government during the 2009 American financial collapse.

For comparison purposes, the loss of wealth to American

households in the 2009 recession totaled an astounding $14 trillion, and the worldwide

loss was $34.4 trillion. Clearly the

screams of "depression" by the economic experts about China

Our little recession of 2009 cost Americans more than

four times as much money as the temporary Chinese drop. We are still trying to recover from 2009 six

years later. China China

It seems as if our financial experts are worthless when it comes to

knowing the Chinese market as the latest flurry of lies and scare tactics

demonstrate. This swift and decisive action

in China should tell us we

continue to depend on a corrupt financial system here in America

There are a few things the Chinese can teach us about

managing the parasites on Wall Street and their protectors in Congress.

.

Tuesday, May 12, 2015

Part 2 - Urban Teen Heroes - the twisted morality of the streets - fanning the fires of discontent? Floyd Mayweather, self-proclaimed greatest boxer in history

.

That is a pretty hefty

claim, to say a welterweight boxer is better than the legendary Joe Louis,

Mohammad Ali, Sugar Ray Robinson, Jack Johnson, Jack Dempsey, or Michael Tyson.

They might just box the ears off the

arrogant cash flasher.

Floyd is the person everyone loves to hate, because

he gives everyone lots to hate.

Mayweather once gave a radio

interview in which he said people sometimes ask him why he hasn’t “given to Africa .”

“Well, what has Africa given to us?” he said.

|

| Joe Louis |

“You hear people talking

about, ‘Well he should give that to charity’ . . . No, I should donate to

Floyd Mayweather.”

The fighter has also been

accused of beating five women, including a 2010 attack on Josie Harris in front

of their son, Koraun. He did two months in prison for the assault.

From the MGM Grand on May

2 to homes across America, boxing fans rained boos on Flamboyant Floyd — but

the only sound the welterweight champ could hear was the ka-ching of cash

registers.

The May 2 fight made him

the highest-paid champ in boxing history, Mayweather hardly seemed to notice he

was also one of the most reviled.

|

| Mohammad Ali |

“The check’s got nine

figures on it, baby,” Mayweather bragged Sunday, as he waved the first of two $100

million checks he earned for beating Manny Pacquiao in a unanimous decision in Las Vegas

“No pictures, though,” he

warned reporters. “Don’t want any pictures of it.”

|

| Sugar Ray Robinson |

He did say he would take

one million dollars in bundles of $250,000 each and share them with the

prostitutes in Las Vegas

"Money"

Mayweather, as he likes to be known, loves to have bags with millions of

dollars in his bed, house, car, or whatever.

|

| Jack Johnson |

Of course, it is good he

wins those hundreds of millions because it keeps him at the head of the pack as

one of the most irresponsible spenders of the modern celebrity era.

Floyd baby has an image to

keep up in order to be the role model he thinks he should be for all those

aspiring kids stuck in the urban ghetto.

|

| Jack Dempsey |

Be like

"Money". He has millions of

dollars in cars.

in planes,

in mansions,

in jewelry,

and God knows what else.

The welterweight

titleholder has also earned the ire of boxing fans, who are less impressed by

his 48-0 record than they are repulsed by his constant bragging, his

selfishness, and his history of assaults on women.

Mayweather, who had a net

worth of more than $300 million before the fight, has gained a reputation for

extreme greed.

|

| Mike Tyson |

After winning, Mayweather

jumped up onto the ropes and flexed his biceps for the crowd — which responded

with vigorous boos.

He was later caught on a

cellphone camera yelling at hecklers: “I told you so! I told you so!”

He admitted the crowd was

against him, saying he was grateful the judges were not swayed.

After the fight,

Mayweather took a pummeling on Twitter.

The Rev. Edward Beck, a

Roman Catholic priest from New York

Newspaper headlines say it all.

His focus on money,

strippers, and suicide are insane influences in kids looking for hope and

guidance, not arrogance and indifference.

We need a new set of real

heroes for our youth. Greed is

yesterday's news and people like Mayweather belong in the forgotten past, not

in our face today.

.

Thursday, May 07, 2015

Part 1. - Urban Teen Heroes - the twisted morality of the streets - fanning the fires of discontent? - Jameis Winston - NFL Superstar or Serial Rapist - you decide

.

Twice in the past few days the hypocrisy of American morality rose to the forefront when Black urban heroes made tens of millions of dollars. Just who are these idols of a generation of young men in our urban areas?

Errors in Inquiry on Rape

Allegations Against F.S.U.'s Jamies Winston

As she gave her account to the police, several bruises began to appear, indicating recent trauma. Tests would later find semen on her underwear.

For nearly a year, the events of that evening remained a well-kept secret until the woman’s allegations burst into the open, roiling the university and threatening a prized asset: Jameis Winston, one of the marquee names of college football.

Three weeks after Mr. Winston was publicly identified as the suspect, the storm had passed. The local prosecutor announced that he lacked the evidence to charge Mr. Winston with rape. The quarterback would go on to win the Heisman Trophy and leadFlorida State

Here is the full report from The New York Times.

Twice in the past few days the hypocrisy of American morality rose to the forefront when Black urban heroes made tens of millions of dollars. Just who are these idols of a generation of young men in our urban areas?

More important, do the

backgrounds of these new heroes reflect at all on the sense of lawlessness,

immorality, and breakdown of the family structure that is fueling the fires of

racial discontent?

A few days ago, the number one pick in the NFL draft is Jameis Winston, the

Heisman Trophy winner from Florida

State University

He is pictured with his NFL contract his first day as a professional, the

ink barely dry on his four-year, $25.3-million rookie contract, which he signed

90 minutes earlier. On television, he looks

and he is emotionless.

The Tampa Bay Buccaneers are his new team.

Yet the Bucs hired private investigators to check out Winston, who’d

been accused of, but not charged with, sexual assault. Twice he was exonerated

by prosecutors, and once by the university after a probe by a Florida

This was a great test of the innocent-till-proven-guilty mantra in the

American justice system, and the authorities could not prosecute Winston. So Winston passed the test. “He kept checking

every box,” Licht said.

Here is what The New York Times had to say about the actions of Winston.

A Star Player Accused, and a

Flawed Rape Investigation

Errors in Inquiry on Rape

Allegations Against F.S.U.'s Jamies Winston

By WALT BOGDANICH

April 16, 2014

Tallahassee,

Fla. — Early on the morning of Dec. 7, 2012, a freshman at Florida State

University reported that she had been raped by a stranger somewhere off campus

after a night of drinking at a popular Tallahassee bar called Potbelly’s.

As she gave her account to the police, several bruises began to appear, indicating recent trauma. Tests would later find semen on her underwear.

For nearly a year, the events of that evening remained a well-kept secret until the woman’s allegations burst into the open, roiling the university and threatening a prized asset: Jameis Winston, one of the marquee names of college football.

Three weeks after Mr. Winston was publicly identified as the suspect, the storm had passed. The local prosecutor announced that he lacked the evidence to charge Mr. Winston with rape. The quarterback would go on to win the Heisman Trophy and lead

Here is the full report from The New York Times.

Woman who accused Jameis Winston of rape sues football star

By Steve Almasy and

Jason Durand, CNN

Updated 12:09

PM ET, Fri April 17, 2015

(CNN)Erica Kinsman, a former Florida State University

Kinsman has said Winston raped her in December 2012.

A prosecutor decided against bringing criminal charges in the case.

In the lawsuit filed Thursday, Kinsman alleges sexual battery,

false imprisonment and intentional infliction of emotional distress.

Winston has said the sex was consensual.

CNN obtained the following statement from Winston's

attorney David Cornwell.

---------------------------------------------------------------------------------------------------

Beyond the lawsuit, Ms. Kinsman was part of a new movie

released this week called The Hunting Ground, about how female college students

are the victims of predators seeking victims to rape.

Is this the kind

of role model we want for our urban youth?

.

Tuesday, March 24, 2015

The NCAA March Madness - the greatest sports event in the world - amateur or professional - in terms of money that is!

.

In spite of the fact college basketball is an amateur sport, there is nothing amateur about the way money is generated from the NCAA playoffs. So massive is the revenue that it far surpasses even the Super Bowl.

Perhaps a better gauge of popularity is the amount people bet on the games and hereLas Vegas knows the winner. For every dollar bet on the Super Bowl, at

least seven dollars are bet during March Madness, well over $7 billion.

In fact, if you combine revenue from the entire NFL playoffs including the Super Bowl, it is one third less than the NCAA playoffs. If you combined all the revenue from the professional NBA, Major League Baseball, and National Hockey League playoffs, it is still one third less than the NCAA playoffs.

King Midas is alive and well in NCAA country.

When it comes to college basketball, one might be driven crazy by all the constant changes in conference members, the odd television broadcast schedules, the incessant drive for perfection, and the big business aspects.

There is a reason for these things as big business is big bucks.

Of course in spite of all the billions of dollars spent during March Madness, the players, those gladiators in the ring, get nothing.

But ad revenue is just a small part of the story. Investopedia identifies four more extremely lucrative ways the tournament makes money, none of which goes to the players:

1) Broadcast rights: In April 2010, the NCAA inked a deal with CBS that made the network its exclusive March Madness outlet. The contract lasts for 14 years and is worth a whopping $10.8 billion. This contract alone is projected to generate $771 million per year for the NCAA.

2) "The basketball fund": The NCAA's annual March Madness revenue is divided among the different basketball-playing schools and conferences (i.e. the Pac-12, SEC, etc.) based on factors such as schools' numbers of sports teams, scholarships awarded and tournament performances.

Conferences also have a hand in divvying up these large money pots (between 2005 and 2011, the top-earning Big East conference made $86.7 million) either evenly amongst schools or based on March Madness performance and revenue generated. According to Forbes, a team's trip to the Final Four earns its conference $9.5 million.

3) Ticket sales and sponsorships: During March Madness, tickets and sponsors generate about $40 million in revenue. Combined with the money from the broadcast rights, this accounts for 96% of the NCAA's total annual revenue.

4) Wagers: What happens in Vegas stays in Vegas, especially if it involves an unlucky March Madness bet. Americans wager an estimated $7 billion a year on the tournament. That is $1 billion more than the Super Bowl.

Also, consider the average ticket price at face value for the final four inIndianapolis is about

$1,400 per person with fees up to $500.

Of course if Kentucky

gets in, from the neighboring state, the scalped price may have no ceiling.

Finally, the economic impact of the NCAA tournament for host cities generates millions and millions of dollars in local revenue not to mention the Friday through Monday night schedule for the Final Four, meaning people will spend four days to see two games.

Because of the complexity of the money trail, I am including an excellent report done by Bloomberg Business on the business of money and the NCAA March Madness. You would do well to review it in detail.

In spite of the fact college basketball is an amateur sport, there is nothing amateur about the way money is generated from the NCAA playoffs. So massive is the revenue that it far surpasses even the Super Bowl.

Perhaps a better gauge of popularity is the amount people bet on the games and here

In fact, if you combine revenue from the entire NFL playoffs including the Super Bowl, it is one third less than the NCAA playoffs. If you combined all the revenue from the professional NBA, Major League Baseball, and National Hockey League playoffs, it is still one third less than the NCAA playoffs.

King Midas is alive and well in NCAA country.

When it comes to college basketball, one might be driven crazy by all the constant changes in conference members, the odd television broadcast schedules, the incessant drive for perfection, and the big business aspects.

There is a reason for these things as big business is big bucks.

Of course in spite of all the billions of dollars spent during March Madness, the players, those gladiators in the ring, get nothing.

But ad revenue is just a small part of the story. Investopedia identifies four more extremely lucrative ways the tournament makes money, none of which goes to the players:

1) Broadcast rights: In April 2010, the NCAA inked a deal with CBS that made the network its exclusive March Madness outlet. The contract lasts for 14 years and is worth a whopping $10.8 billion. This contract alone is projected to generate $771 million per year for the NCAA.

2) "The basketball fund": The NCAA's annual March Madness revenue is divided among the different basketball-playing schools and conferences (i.e. the Pac-12, SEC, etc.) based on factors such as schools' numbers of sports teams, scholarships awarded and tournament performances.

Conferences also have a hand in divvying up these large money pots (between 2005 and 2011, the top-earning Big East conference made $86.7 million) either evenly amongst schools or based on March Madness performance and revenue generated. According to Forbes, a team's trip to the Final Four earns its conference $9.5 million.

3) Ticket sales and sponsorships: During March Madness, tickets and sponsors generate about $40 million in revenue. Combined with the money from the broadcast rights, this accounts for 96% of the NCAA's total annual revenue.

4) Wagers: What happens in Vegas stays in Vegas, especially if it involves an unlucky March Madness bet. Americans wager an estimated $7 billion a year on the tournament. That is $1 billion more than the Super Bowl.

Also, consider the average ticket price at face value for the final four in

Finally, the economic impact of the NCAA tournament for host cities generates millions and millions of dollars in local revenue not to mention the Friday through Monday night schedule for the Final Four, meaning people will spend four days to see two games.

Because of the complexity of the money trail, I am including an excellent report done by Bloomberg Business on the business of money and the NCAA March Madness. You would do well to review it in detail.

March Madness Makers and

Takers

The way the NCAA

distributes the staggering revenue from the basketball tournament has created a

polarized system where some schools make money and others just take it.

By David Ingold and Adam

Pearce | March 18, 2015

Twenty five years ago, the NCAA

decided something had to be done about March Madness money. The year before,

CBS agreed to pay a record $1 billion to broadcast the 1991-1997 tournaments.

That was fine with the powerhouse basketball schools that routinely made it

into the postseason: Under the rules at the time, they divided most of the revenue

based on the number of games they won.

Conference officials feared that without a change, a handful of schools would get rich while others got nothing, and the student athletes competing in the tournament would face increasing financial pressure to win games.

Conference officials feared that without a change, a handful of schools would get rich while others got nothing, and the student athletes competing in the tournament would face increasing financial pressure to win games.

Annual TV revenue from NCAA Division I men’s basketball

tournament $800 million CBS and Turner Broadcasting begin $10.8 billion ,

14-year deal Basketball Fund goes into effect after CBS nearly triples annual

revenue to $143 million ,TV rights switch to CBS from NBC Source: NCAA reports

Note: Chart shows the average annual rate over the course of a contract.

The Basketball Fund Is Born

So in 1990 the NCAA created the

“basketball fund,” a plan intended to more fairly divvy up tournament revenue

and parcel it out among the country’s Division I schools.

The new plan cut the amount of the payout that’s directly tied to teams’ wins and losses. Most of the tournament’s TV revenue is now earmarked for things like academic programs and financial assistance for student athletes. Even schools that don’t play in the postseason get a cut.

The remaining amount makes up the basketball fund—and it’s no small pot. Last year the fund totaled about 28 percent of the tournament’s TV revenue, or about $194 million. These coveted dollars are won or lost on the basketball court, and the battle among schools to claim them accounts for a lot of the Madness each March.

The new plan cut the amount of the payout that’s directly tied to teams’ wins and losses. Most of the tournament’s TV revenue is now earmarked for things like academic programs and financial assistance for student athletes. Even schools that don’t play in the postseason get a cut.

The remaining amount makes up the basketball fund—and it’s no small pot. Last year the fund totaled about 28 percent of the tournament’s TV revenue, or about $194 million. These coveted dollars are won or lost on the basketball court, and the battle among schools to claim them accounts for a lot of the Madness each March.

The tournament TV contract brought in $700 million in 2014…

$498 million went to Division I schools… with $194 million given via the

basketball fund… $199 million this year … and that amount keeps growing.

How It Works

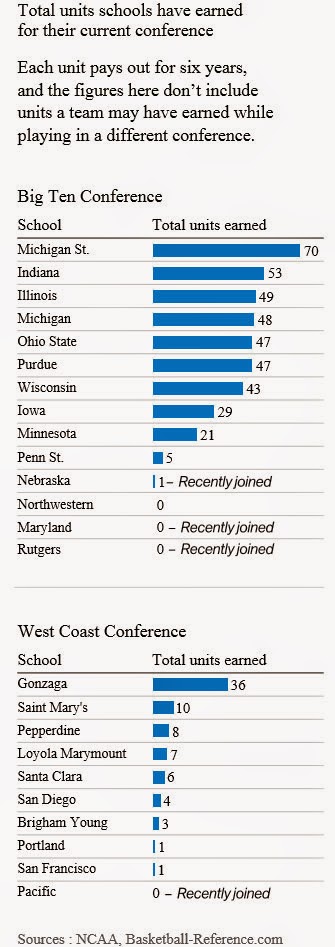

Teams earn a “unit” for every

tournament game they play up to the championship game. So a team that makes it

to the final four will earn five units. Each unit is worth a specific amount

each year. Instead of paying schools directly for the units they win, however,

the NCAA now gives the units to a team’s conference, and the conference is

responsible for distributing the money to its members. A conference can divide

up the money however it wants, but the NCAA suggests schools evenly split the

payout, and most conferences follow the recommendation.

The End of the $300,000 Free

Throw

One goal of the basketball fund

was to reduce the financial impact of individual wins and losses. Under the old

system in which schools were paid each year for their wins, a player who missed

a single game-winning free throw cost his team $300,000 or more. The fund

changed that by spreading out the tournament payments over six years; and since

that money is also split among the dozen or so teams in a conference, the

dollar value attached to any single game is diluted.

Every unit won in 2015 will be worth at least $1.6 million over six years. For a strong team likeKentucky ,

which might earn as many as five units if it makes it to the final four, that

once meant a massive payout at the end of the tournament. Under the basketball

fund, those units will be split with the other 13 schools in the Southeastern

Conference—dropping the per-school value of its units earned this year to about

$560,000 over the next six years.

Every unit won in 2015 will be worth at least $1.6 million over six years. For a strong team like

Conferences Are Key

One big effect of the fund is

that it shifts the emphasis from winning teams to winning conferences. All 350

Division I teams will get a cut of this year’s $200 million basketball fund—but

strong conferences with many winning teams will rack up more units and take

home a much bigger share of the pile.

The nation’s top basketball programs have historically been in one of six major conferences: the ACC, Big East, Big Ten, Pac-12, Big 12, and SEC. These conferences only account for 20 percent of the teams in Division I, but they’ll likely receive about 60 percent of the basketball fund payout this year.

The fund is supposed to be about rewarding performance, and it’s fitting that the top programs will receive the largest cut of the money. But the strongest conferences also include schools with weak basketball programs—and they get an equal cut of the winnings even if they didn’t play a single game in the tournament.

The nation’s top basketball programs have historically been in one of six major conferences: the ACC, Big East, Big Ten, Pac-12, Big 12, and SEC. These conferences only account for 20 percent of the teams in Division I, but they’ll likely receive about 60 percent of the basketball fund payout this year.

The fund is supposed to be about rewarding performance, and it’s fitting that the top programs will receive the largest cut of the money. But the strongest conferences also include schools with weak basketball programs—and they get an equal cut of the winnings even if they didn’t play a single game in the tournament.

Basketball Fund earnings by conference, 1991 - 2015

A System of Makers and Takers

This focus on conferences instead

of teams has resulted in a system of makers and takers, where colleges in a

conference lean on a few key schools with powerful basketball teams to earn

money for everyone else.

Take Michigan State Kansas , Kentucky , and North

Carolina .

This effect is magnified in smaller conferences, where a single team could be responsible for the bulk of tournament appearances.Gonzaga University

The inverse can be true for weak programs in strong conferences. An extreme case would beNorthwestern

University Michigan

State

Despite contributing zero units over the last 30 years, Northwestern has received an estimated $24.5 million from the fund. This year, the school will receive roughly $2.2 million, the same amount asMichigan State

The chart below compares how much schools have earned for their conference and how much they've gotten back. It assumes conferences equally split their basketball fund revenue like the NCAA suggests. Looking at all the schools together, it's clear that some are getting back a lot more than they put in.

This effect is magnified in smaller conferences, where a single team could be responsible for the bulk of tournament appearances.

The inverse can be true for weak programs in strong conferences. An extreme case would be

Despite contributing zero units over the last 30 years, Northwestern has received an estimated $24.5 million from the fund. This year, the school will receive roughly $2.2 million, the same amount as

The chart below compares how much schools have earned for their conference and how much they've gotten back. It assumes conferences equally split their basketball fund revenue like the NCAA suggests. Looking at all the schools together, it's clear that some are getting back a lot more than they put in.

Makers and takers by conference, 1991 - 2015

Movers and Shakers

Schools are continually changing

conferences, typically to improve their financial situation. Though

football-related money is the biggest motivator, all that jumping around also

has a big impact on the basketball fund, since schools rely heavily on one

another for units. Conferences with multiple earners can tough out the loss of

a powerful team. But the departure of a breadwinner can mean a huge financial

hit for weaker conferences.

Take the Horizon League, a mid-sized conference with schools from theMidwest that doesn’t have the depth of the ACC or Big

Ten. Twice the conference has lost its top earner to the Atlantic 10, a more

financially attractive conference. Xavier left in 1995, Butler in 2012. The last of the units Butler earned for the

Horizon League expire in 2016, and if another program doesn't step up, the

League’s revenue could drop to $1.6 million in 2017 from $5 million in 2011.

Take the Horizon League, a mid-sized conference with schools from the

The West Coast conference now

faces a similar situation with Gonzaga

University Spokane , Washington

.

Labels:

2015,

ACC,

Big 12,

conferences,

gambling,

Kentucky,

March Madness,

money,

money to colleges,

NCAA,

PAC 12,

payout,

SEC,

ticket prices,

TV revenue

Subscribe to:

Posts (Atom)